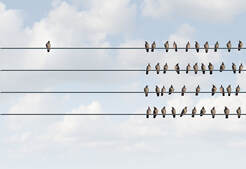

Bifurcated Stock Market

Bifurcated Stock Market So far, bad prediction – at least at the index level. With the first 6 months of 2024 under its belt, the S&P 500 is up 14% and change; the NASDAQ up a little further.

But pull back the covers a bit, and the analysts are not that far off the mark. For example, the S&P 500 equal-weight index is up a more modest 3.82% for the year. What’s that, and why does it matter?

RSS Feed

RSS Feed