The Five Stocks Monthly Trading Strategy

David Alan Carter

April 24, 2022 Every investor is a stock picker at heart. But to do it right, every pick requires some degree of heavy lifting in the form of time and research, not to mention attentiveness once the trade is made. The latter, because every pick requires two decisions: when to get in, and when to get out.

But let's be honest. We're rarely logging the necessary time and attention. More often than not, we're reacting to a tip, going with a hunch, or otherwise flying by the seat of our pants. |

And sadly, the market returns for the average retail investor reflect that.

The new Five Stocks monthly trading strategy promises to crunch the data and shoulder that heavy lifting itself, providing a rules-based algorithm specifically tuned to stock selection.

The new Five Stocks monthly trading strategy promises to crunch the data and shoulder that heavy lifting itself, providing a rules-based algorithm specifically tuned to stock selection.

|

UPDATE: Five Stocks has completed beta testing and went live on April 2, 2023. You can find it on the Pricing Page in the MAX Pak plan. |

Strategy Overview

|

Five Stocks is our one and only true stock-picking model, the first new strategy offering since the website went live in January 2019. Yes, American Muscle has a component that will periodically tap one or two individual names from the S&P 500. A component, by the way, that has boosted performance of that strategy over the years.

But Five Stocks takes stock picking to another level. Each month it selects up to five individual names from a curated portfolio of U.S. stocks listed on the Nasdaq and the NYSE. These are not your penny stocks or your untested IPOs. Rather, these are among the largest names in the exchanges, stocks that figure prominently in benchmark indices including the Nasdaq 100, the Dow Jones Industrial Average, and the S&P 500. The strategy employs a dual momentum formula to identify its monthly stock picks. A stock must show relative strength over its peers in the curated portfolio (i.e., relative momentum), while at the same time showing a positive - upward - trend relative to it's own historical performance (i.e., absolute momentum). The value of momentum has been well documented over the years, and forms the basis for most of our strategies. [Relative strength momentum is the tendency of assets that have had the strongest performance in the recent past to continue to outperform going forward and assets that performed the worst over the recent past tend to continue to underperform.]

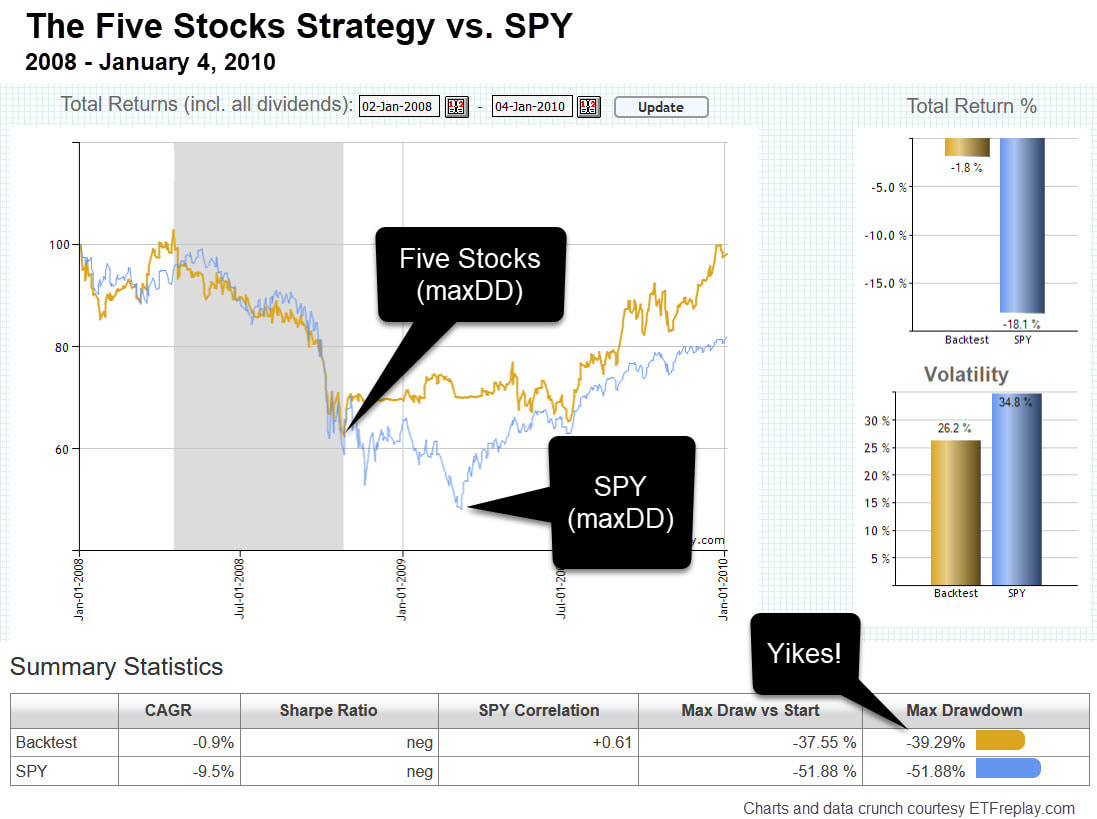

In fact, the strategy has gone to 100% cash twice during a 14-year backtest (as you might imagine, once in each of 2008 and 2009). That cash trigger helps bring risk to a more manageable level. But keep in mind, individual stocks will always carry more risk than ETFs or mutual funds.

In sum, the Five Stocks strategy provides a rules-based algorithm specifically tuned to stock selection while providing some crash protection in bear markets. The strategy combines well with more conservative strategies like The 12% Solution, Bond Bulls, or Lean Muscle - and with our non-U.S. equity strategy Global Trader. |

Strategy Assets

|

Equity Assets

At the heart of the Five Stocks strategy is the equity portfolio. This is a curated portfolio of large and mid-cap stocks, the components of which are subject to change over time. In general, the portfolio is overweight technology and underweight financials (specifically, commercial and investment banks). Beyond that, represented industries include: aerospace and defense, bio-pharmaceutical, broadcasting and entertainment, consumer services, financial services, food and beverage, home improvement, industrial and manufacturing, information technology, insurance, managed health care, medical appliances and equipment, pharmaceutical, retailing, semiconductor, software, transportation, travel technology, and utility services. Because the portfolio will periodically add or remove a company, the strategy's list of potential candidates is ever changing. Current names on the list may undergo a merger (e.g. recent mergers of Activision Blizzard by Microsoft, and United Technologies by Raytheon) and be removed from the portfolio. Newer companies may grow in market cap until they are picked up by one or more of the popular indices, catch our eye and become a candidate for backtesting - and if results are promising, added to the portfolio. The portfolio will always have a minimum of 50 names, and no more than 100. The current number of components is 79. Hedge Asset Our "flight to safety" asset is SHY, the iShares 1-3 Year Treasury Bond ETF. This is our proxy for cash, and in fact investors may elect to simply hold cash when indicated. |

The Mechanics

|

Selecting For Relative Momentum

Each month, using a blend of relative strength indicators, the algorithm calculates the momentum of each of the stocks in our equity portfolio. Stocks are evaluated for both short-term performance (weeks) and longer-term performance (months). It identifies the 5 leading candidates. Cash Trigger After these 5 momentum names are selected, each must demonstrate an upward trend relative to it's own historical performance (i.e., absolute momentum). To do this, the algorithm uses a long-dated moving average. Long-dated MAs are commonly used by investors to gauge bullish/bearish sentiment in stocks. Should any of the 5 names fall below their respective MAs, their portion of the strategy will go to cash. So for example, if 2 of the top 5 picks are trending below their long-dated MAs at the end of the month, the strategy will swap out those two picks for SHY. The allocation for that month would be 60% in equities (20% each for the three stocks trending above their MAs), and 40% in SHY. As mentioned before, investors may wish to simply hold cash instead of SHY when indicated. To Sum It Up At any given time, Five Stocks holds up to 5 individual stocks from a curated list of some of the largest companies in the Nasdaq 100 index, the Dow Jones Industrial Average, and the S&P 500, each making up 20% of the strategy. However, if any of these 5 picks are exhibiting a bearish trend at the time of rebalancing, their portion is allocated to cash. Rinse and repeat monthly. |

Three Charts Tell The Story

|

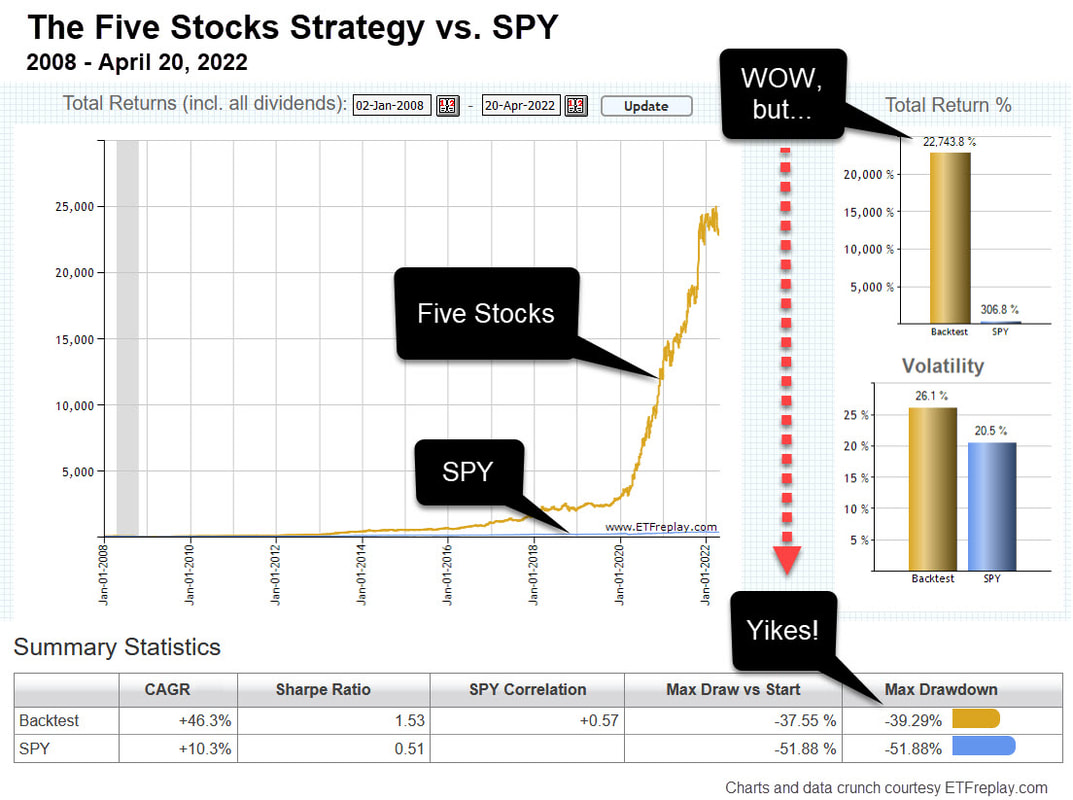

So, just a heads up to potential investors - during significant bear markets, this is not a cake walk. The potential for large drawdowns is the primary reason for keeping a reasonable allocation of this strategy within one's larger portfolio. [See Allocating Within Your Portfolio, below.]

Was the year 2020 an anomaly?

The year 2020 was just flat out bizarre; one of the worst times for humanity, and yet the Five Stocks strategy returned 306%. The following year, 2021, wasn't too shabby either, returning 98%.

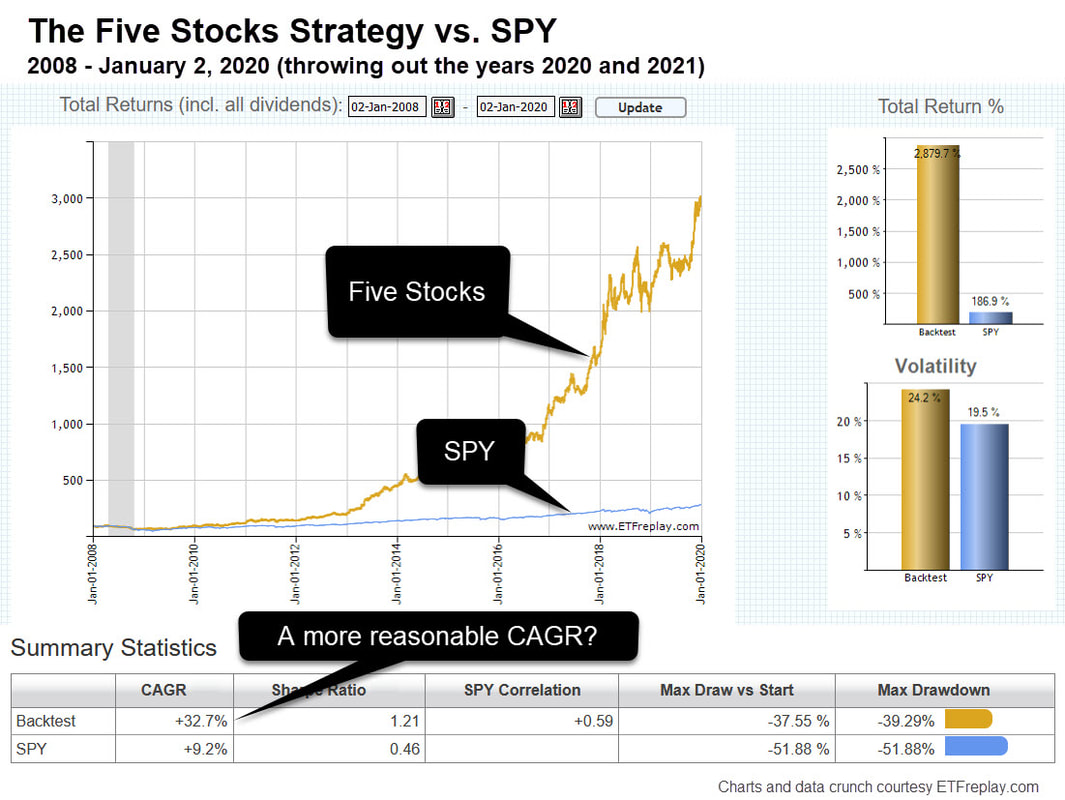

In this final chart, we show the returns from 2008 through 2019 - stopping shy of the COVID 19 lockdowns and subsequent recovery. While the CAGR of 32% is still over-the-top spectacular (I'm begging you, don't expect this kind of return every year), I'm a little more comfortable leaving 2020 out of the mix - at least when it comes to imagining the strategy's potential going forward.

|

Allocating Within Your Portfolio

|

Because Five Stocks consists of individual stocks, this strategy will see higher risk metrics than other models that focus on traditional ETFs. So as you can imagine, Five Stocks was not designed to occupy more than a portion of one's total investment portfolio. How much of a portion? That depends on one's risk tolerance. Let's drill down on that.

Imagining an all-stock portfolio... First, let's pretend an investor was building a portfolio of nothing but stocks. No mutual funds, no ETFs, no bond funds. Just stocks. Now, our strategy in full form holds up to 5 stocks in a given month. So, is 5 stocks sufficient for an all-stock portfolio? Short answer - no. A handful of stocks simply doesn't provide the needed diversification and creates the potential for severe losses in your portfolio's value. So beyond a handful, more is better - right? Well, to a point. There is such a thing as over-diversification, which can limit returns with no perceivable advantage of further risk reduction. Sweet spot? Is there an optimal number of stocks in an all-stock portfolio? A number that maximizes the risk/return ratio? The experts weigh in:

Of course, the right number of stocks for an investor also depends on the individual’s investment style and objectives, with a more aggressive approach requiring fewer stocks (closer to 10) and a more conservative approach requiring more stocks (30 or more). Now, we've been imagining a portfolio made up entirely of stocks. And clearly, our Five Stock strategy will only get you part of the way there. But we're not trying to build an all-stock portfolio. The idea behind Five Stocks is to provide a boost to a portfolio that's already employing one of our other strategies - or combination of strategies - that generally offer better risk metrics (due to ETF components, and different hedging safeguards). So back to the question, how much to allocate? If we use 20 individual stocks as a good rule of thumb for an all-stock portfolio, Morningstar strategist Amy Arnott makes the next logical inference. "You want to make sure you never allocate more than 5% of your portfolio to any one stock." The 5% Rule That "5% rule" is a common theme echoed among financial advisors. So let's do the math. We've got 5 stocks in the strategy. If each of those stocks were to occupy the maximum of 5% within our portfolio, then the strategy could occupy up to 20-25% of our portfolio. If that sounds like a lot, it is - and I would reserve that allocation for only the most aggressive investors. Moderate to conservative types may wish to reduce their per-stock allocation to 2% or 3%, giving the strategy a 10% to 15% allocation within their portfolio. Even then, I would suggest starting out less than that; give it a few months at 5% or so to get a feel for the strategy. You can always increase that percentage as time goes by. Whatever allocation you initially decide on, keep in mind that one can always ease into a new situation. If you've decided a 10% allocation within your portfolio is right for your risk profile, think about going in half on day one, and pick up the other half midway through the month using the provisional picks as a guide. Or, as suggested above, go 5% for the first couple of months, and boost that to 10% once you're comfortable with the strategy and its performance. Give yourself some time to see how the strategy works and get comfortable with the volatility before committing all the funds you've earmarked. That's good advice for any trading strategy or single investment. |

Managing Risk

|

An investor wrote, "Stocks can get killed. Is there anything we can do to lessen the risk?"

Yes, individual stocks can get killed. It happens every day. In fact, I'm writing this the day after Netflix's earnings report on April 19, 2022. The stock was crushed - down 35% on the day. That's on top of a 40% decline for the year - and we're only 4 months into the year. [Thankfully, the strategy hasn't owned Netflix since October 2021, when it contributed 11% to the model for that month.] A disappointing earnings report, unflattering news, a competitor's good fortune, a Presidential tweet -- any number of things can conspire to throw a stock's price off a cliff. Over a 14-year backtest, stocks that the strategy has carefully selected after meeting all the criteria for upside potential routinely take significant, double-digit hits - 10%, 15%, 20% and more. The very first month of the 15-year backtest, that being January 2008, the strategy chose Apple as one of the 5 picks for that month. Apple lost 31% of it's value in the next 30 days. In October of 2018, the strategy selected Advanced Micro Devices. The stock promptly dropped 35% that month. How can this be? Because stocks are stocks. You can have every technical parameter known to mankind filtering for risk, and your 'anointed' stock can still crash and burn the day after you buy it. That's just the nature of the beast. There will always be an element of unpredictability associated with stock investing. And especially when you veer off from the bond proxies and the Blue Chip stalwarts and into high-tech movers and shakers. So, what can investors do to lessen the risk? Number 1: Check your allocation. As I mentioned above, a 20% or so allocation of Five Stocks in a portfolio should be reserved for only the most aggressive investors. For moderate to conservative investors, half that amount - or less - sounds more reasonable. Of course, it matters mightily what you're doing with the remaining 80-95%. If the bulk of your portfolio is conservative (i.e., largely bond funds, bond proxies, or conservative ETFs and mutual funds), you can afford a greater percentage of Five Stocks (or any other relatively high-risk strategy). On the other hand, if the bulk of your portfolio is made up of additional high-beta stocks or some other high-risk strategy, reduce your allocation to Five Stocks. For a detailed example of a portfolio made up of 75% Bond Bulls and 25% White Knuckle, see my article on Seeking Alpha: Headline Risk and Monthly Trading Models - Keeping Drawdowns In Check. True, The White Knuckle is not Five Stocks, but the article will provide some insight into combining strategies with quite different risk profiles. Number 2: Dodge earnings. Generally speaking, all other things being equal, the most volatile time for any publicly-traded stock is the date they post quarterly earnings. Now, that volatility can be good (the stock pops on better than expected results), or bad (the stock drops on disappointing results.) If you avoid those monthly picks that have an earnings release on the calendar in the upcoming month, you'll avoid any potential downside surprises from earnings. Of course, you'll also miss any upside surprises as well. But if you're looking to reduce risks in this strategy, dodging earnings is an option. Here are three ways for handling a stock that is expected to post earnings in the upcoming month: 1) Avoid the stock altogether, and replace it with SHY - or cash - for the month, or 2) avoid the stock and watch for the next provisional pick that pops up (that doesn't have an upcoming earnings report itself), or 3) hold the stock in question, but dump it (or reduce your exposure by half or so) a day or two prior to its earnings release date. How do you know when a company is expected to release their next earnings report? Check the tool box just beneath the Trade History table. You'll find a link to the earnings calendar over at Nasdaq.com. Plug in your stock's symbol in the gray search bar, and note the date. Number 3: Place stop losses. Consider placing stop losses on one or more individual names within the strategy. Now, I'm not a particular fan of stop losses, and I detail why in a Q&A on the Members Page. But they are a legitimate form of risk management, and appropriate in some instances. One of those instances might be when you've gone overboard in your allocation of this strategy, and you're lying in bed with the Big Eye at night. Or if your time frame for investing is only a few years or less. Or you're uncertain as to the level of downside you can actually tolerate. For any of these reasons (and others), placing a trailing stop loss on some or all of the names on the list might be a prudent consideration. A reminder: stop losses will not protect you from overnight plunges. For example, if a stock you're holding posts disappointing earnings after hours, the next morning the stock will gap down, possibly taking out your stop at a much lower price than you expected. A stop-limit order (vs. a stop-loss order) can guarantee a price limit, but the price may not get filled and the investor is left holding the stock. If considering stops, do your research and decide your best course of action. Number 4: Keep an eye on the provisional picks. If you're not a fan of stop losses (and I can't blame you), keep in mind that every trading day I update the Members Page with the strategy's "provisional picks" (look at the bottom row of the table marked Trade History). Provisional picks represent an insight into what the strategy is thinking at the moment. They are the stocks that would be picked if you decided to update your portfolio as of the close of the most recent trading day. Although the strategy only rebalances (buys/sells) one day a month, it recalculates daily based on closing prices. Potentially, provisional picks could change each day as markets moves in myriad directions. The reason we don't normally trade each provisional pick is because much of this is noise that gets filtered out by adhering to a monthly schedule. But as an alternative to placing stop losses on the stocks in the strategy, consider checking these provisional picks a couple of times a month - or more. If, for example, on the 15th of the month the provisional picks show a dramatic change - from 5 individual stocks to only 2 stocks and the balance in cash (SHY), or from primarily tech companies to healthcare names, for example - don't be afraid to implement a rebalance to mirror those provisional picks. Especially if you notice that a news event has acted as a catalyst to shift the market. Sadly, it's a judgement call as to if, when, or how often you elect to implement such a trade. It's probably not something you want to do as a routine policy. But by trading provisional picks prudently, investors may be able to trim losses and/or boost returns a bit on occasion. In Sum The problem with any trading model that rebalances monthly is that there is always the chance for that model to get caught flatfooted during the month, in between rebalancing. Keeping your allocation in check is the first step in risk management. Five Stocks, like all the strategies, is a long-term model. In the end, a bad month here and there will be offset with good months, as the strategy self-corrects. If your allocation is reasonable and you have a long-term perspective, odds are you're good to go. And for investors looking for additional safeguards, stops and/or dodging earnings reports can be ways to help protect against downside events in between regular rebalancing. And so are provisional picks, if used judiciously. By the way, remember that month Apple got clobbered? And Advanced Micro Devices? Those months ended up returning -9.8% and -14.61% respectively. The other 4 stocks in the lineup helped cushion the blow. Now, those were still tough months to live through, but they were survivable to the investor with a reasonable allocation of the strategy within his or her portfolio. |

Some Final Thoughts

|

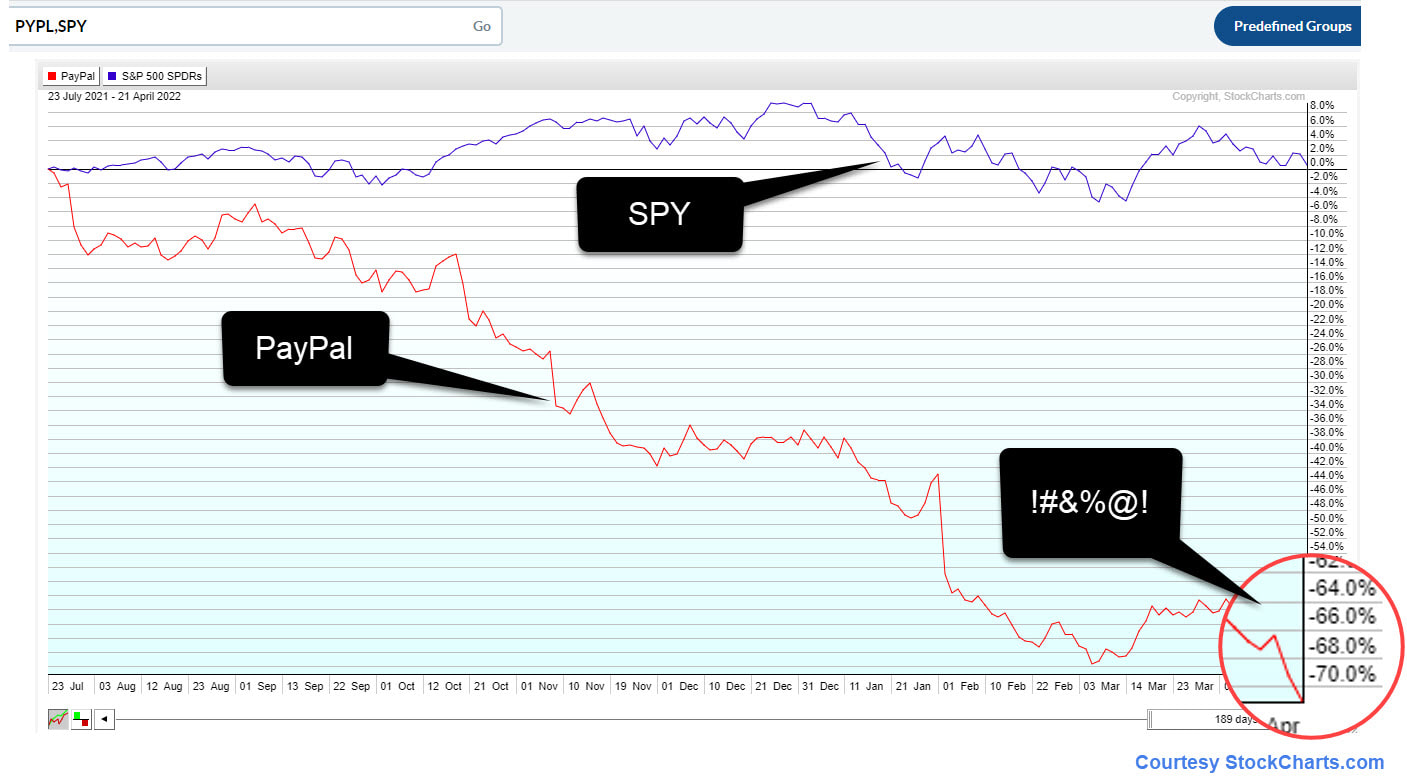

Believing PayPal to be a small but core holding for the foreseeable future, I watched in disbelief as it began what would turn out to be an historic slide - down over 70% since July 2021. A slow-motion train wreck. Multiple times I had the opportunity to get off that train, but didn't.

It's funny what happens when you get emotionally attached to a stock - you tend to ignore obvious signs of trouble, or excuse them. If only there was a cold-hearted, emotionless machine that could have gotten me out of this (and others) before so much damage had been done. Now there is. The new Five Stocks monthly trading strategy provides a rules-based algorithm specifically tuned to stock selection while providing some crash protection in bear markets. It tells us what to buy, when to buy, when to sell, and what to replace it with. It doesn't get everything right all the time. But over the long run, the hits outweigh the misses. [Over a 14+ year backtest, the strategy has seen winning periods 66% of the time, and losing periods 34% of the time, with the median winning period +5.52% and the median losing period -2.74%. This, after 1,315 trades.] Importantly, the strategy combines well with more conservative strategies like The 12% Solution, Bond Bulls, or Lean Muscle, and with our non-U.S. equity strategy Global Trader. Why talk combinations? Because Five Stocks wasn't meant to occupy one's entire portfolio (as detailed above in Allocating Within Your Portfolio). Multiple strategies at work in a portfolio, especially when those models tend toward an inverse relationship with each other or focus on different asset classes or market sectors, not only provides diversity but brings down volatility and max drawdown. Yes I know, it also brings down returns. But we all need to balance risk and returns so that we can 1) sleep at night, and 2) stay invested. Five Stocks has just completed extensive beta testing and will go live April 1, 2023. Remember, the website's Disclaimer and Terms of Use apply to this strategy as well as all others. Best of luck, David Alan Carter |