The White Knuckle

|

The real rub? The 3:1 ratio works in the opposite direction as well. If the index drops 1%, the loss would then be 3%.

Just to be clear, these are primarily vehicles for the day-trading crowd. To buy one of these 3x funds with the intention of blindly holding on for a month is borderline nuts. So, what in the world am I doing buying three? Well, let's see how this works out.

Just to be clear, these are primarily vehicles for the day-trading crowd. To buy one of these 3x funds with the intention of blindly holding on for a month is borderline nuts. So, what in the world am I doing buying three? Well, let's see how this works out.

A Quick Take

|

The Strategy splits its portfolio into 50/50.

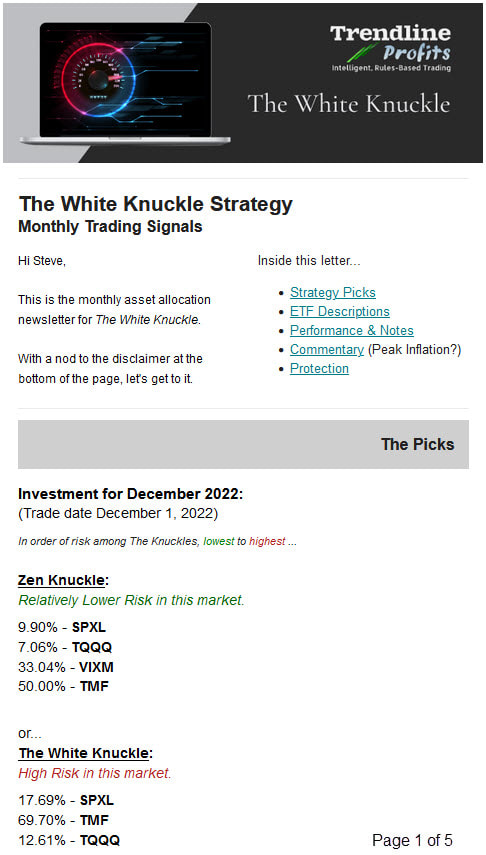

The first half of the portfolio holds three of the most volatile names in market: two leveraged equity funds, and a leveraged Treasury fund to provide some counterbalance. To further balance this core, the percentage portions of each ETF will change each month according to a risk-parity calculation. The second half of the portfolio rotates primarily among hedge candidates, although the strategy can use that portion to double-down on either the equity funds or the Treasury ETF should the stars align. A wild ride. The White Knuckle is my most aggressive ETF model. While I've mitigated some of that aggression with risk-parity and currency hedges, volatility outpaces the overall market. For that reason, I don't advocate employing this in more than 5-15% of your portfolio. However, it does combine well with more conservative models, such as Bond Bulls, to form a more balanced portfolio. And then there was Zen. Built on the original, the Zen Knuckle variation (included with the subscription) makes a change to the mix of funds in the core 'risk-parity' portion of the strategy. The result is a significant reduction in risk. Geared for investors willing to forgo some of the high-powered performance in return for calmer, gentler ride. There's more information below, but if you're ready, why wait? You can be placing your trades today.

|

Need more information? OK, let's go in-depth...

Numbers & Charts

|

Over the past 13+ years, from 2011 to 2024 YTD, The White Knuckle has delivered a 10-fold improvement in Total Return over our benchmark SPY. That's right: 10-fold.

Total Return Chart White Knuckle vs. SPY, our proxy for the S&P 500

Total Return | 2011 - 2024 YTD (updated monthly) Now, The White Knuckle delivered these returns with higher volatility and a max drawdown roughly comparable to our benchmark (see the Compare Strategies page for recent drawdown numbers). So, caution is advised here. Annual Returns White Knuckle vs. SPY

Annual Returns | 2011 - 2024 YTD (updated monthly) Now, individual years can vary - sometimes dramatically. The year 2021 is a good example; the strategy underperformed the S&P 500 by half. And in the bear market of 2022, the strategy's losses were more than double that of the S&P 500. So let this be a heads up: not every month, not every year is a slam dunk. In sum, The White Knuckle is a very aggressive play for the U.S. equity market, with eye-popping returns commensurate with the risk. |

Strategy Assets

|

The following ETFs are included in The White Knuckle strategy:

Risk-Parity Assets Of the three, 3x leveraged ETFs in our portfolio, one customarily acts as a hedge to the other two, providing a modicum of balance to begin with. Here are the funds in question:

The last one on the list, TMF, is basically long-term bonds on steroids. Over time, long-term bond funds have tended to have an inverse relationship with U.S. equities, of which SPXL and TQQQ represent in spades. But a word to the wise: in the stock market, as in the world at large, things are not always certain. Should all three funds decide to go down in unison, the results can be ugly. I try to mitigate some of that potential ugliness with risk-parity (explained in more detail in the section "The Mechanics." Hedge Candidates Finished? Not quite. In an effort to further reduce the risk inherent in owning these three levered funds, risk-parity notwithstanding, I added a "part-time" hedge that brings the following funds into play:

I say "part-time" hedge because it doesn't always kick in. I'll explain. |

The Mechanics

|

As mentioned above, the strategy has two components, a risk-parity component and a hedge component - each 50% of the portfolio. Each component operates within its own parameters and with its own set of assets. Here's how that works...

50% Risk-Parity Component Once a month, the strategy conducts a risk-parity calculation on the three, 3x leveraged ETFs to determine the percentage each should occupy in the portfolio going forward. It rebalances those funds according to those percentages. Each month, month after month, these three assets are ever-present in the portfolio -- only by differing amounts. _____ What is Risk-Parity? Assets come with their own risk profile, which is influenced by the market and changes with time. A common example is stock and bonds; stocks are generally considered more risky than bonds. If an investor in these two assets wanted to keep the overall risk in his portfolio constant, all other things being equal, he or she would own more bonds than stocks. Then periodically reevaluate, and maybe add to stocks and subtract from bonds, or vice versa, all the while working to keep the overall risk constant. That's risk-parity; holding different assets and periodically changing the portion of each asset owned to keep the overall risk constant. On Wall Street, the higher the volatility, the riskier the asset. When the volatility of equities spike, risk-parity traders move to exchange some of their stock holdings for bonds. Likewise, when volatility rattles the bond market, these traders reverse course and exchange bonds for stocks. So, using volatility as our gauge, risk-parity overweights securities with lower-than-average volatility, and underweights securities with higher-than average volatility. For our purposes, this weighing mechanism is recalculated each month, and each fund is assigned a percentage that takes into account its relative volatility. For example, if volatility increases in the equity markets, implying an increased risk of a downturn, risk-parity would give more weight to the bond fund TMF and less to the equity funds SPXL and TQQQ. 50% Hedge Component The remaining 50% of the portfolio provides an opportunity to hedge those risk-parity bets. Using a relative strength test, if one or two of our hedges (the currency funds and the inflation-protection ETF mentioned above) exhibit significant momentum strength, those hedge fund (or funds) will be selected to represent 25-50% of the portfolio. And if none of the hedges test strongly? Then the strategy will double down on one - or two - of those risk-parity plays. Why all the gymnastics? Because I didn't want to commit three, 3x leveraged ETFs to 100% of the portfolio if I could hedge a portion of that with an alternative, especially when that alternative acts to reduce overall strategy volatility and max drawdown (maxDD). Summary At any given time, The White Knuckle Strategy holds 3 leveraged ETFs of varying proportions that collectively make up either 100% of the portfolio, or 75-50% of the portfolio with the remainder in one or two "hedge" ETFs for further downside protection.

Benchmark: SPY (the ETF that tracks the S&P 500 Index) is used as the benchmark by which we'll judge the performance of The White Knuckle. _____ Note: while the strategy fades higher-risk equity funds and increases allocation into the relative safety of bonds and currency hedges in the event of broad market downturns, nothing short of perpetually holding cash will protect in the event of a flash crash or a sudden jolt to equity or bond markets. One final but VERY important note: Because of the aforementioned risk, The White Knuckle was not designed to occupy more than a portion of one's total investment portfolio. Maybe 5% - 10% - 15% or so, depending on one's risk tolerance. Despite the guardrails, this remains a relatively high risk strategy. |

What You Get

|

|

Ready?

|

The White Knuckle Strategy is $21.95 or $24.95 per month depending on the package selected (not available as a stand-alone strategy). Cancel at any time; no questions, no hassle. Follow along and see how the strategy catches market moves to the upside, while protecting hard-earned portfolios against major downdrafts.

First 2 months are FREE. |

"Thank you for your help navigating these markets. I love your new Zen Knuckle. I know I’m just one vote out of many but my vote is for Zen to replace White. Either way though I’m happy". --Zach H. |

"Just want you to know how much I appreciate the value you provide. Knowing that hedge fund managers are charging 2 and 20, I happily send you $180 a year! I am so impressed by the transparency and the ongoing historical data, and the strategies make sense to cover any investor risk profile and mindset. My wife and I are fortunate to be in a position to be just fine for the rest of our lives if we don’t do anything stupid, and your strategies help me manage our portfolio with great confidence. Thanks for all the great work." --Dennis P. |