Zen Knuckle is a VARIATION of The White Knuckle that introduces a new ETF into the mix. A seemingly small change that makes a big difference in returns - and risk. This paper will explore...

- What is "the VIX"?

- What does the volatility ETF VIXM do for the strategy?

- How does this variation compare to the original White Knuckle?

|

As a reminder, the risk-parity portion of our model employs three funds consistently, month in and month out, but by differing proportions. Those funds - in the original White Knuckle - are two equity ETFs (SPXL and TQQQ) and the leverage bond fund TMF. The strategy then uses a risk-parity calculation to adjust the amount of each for any given month.

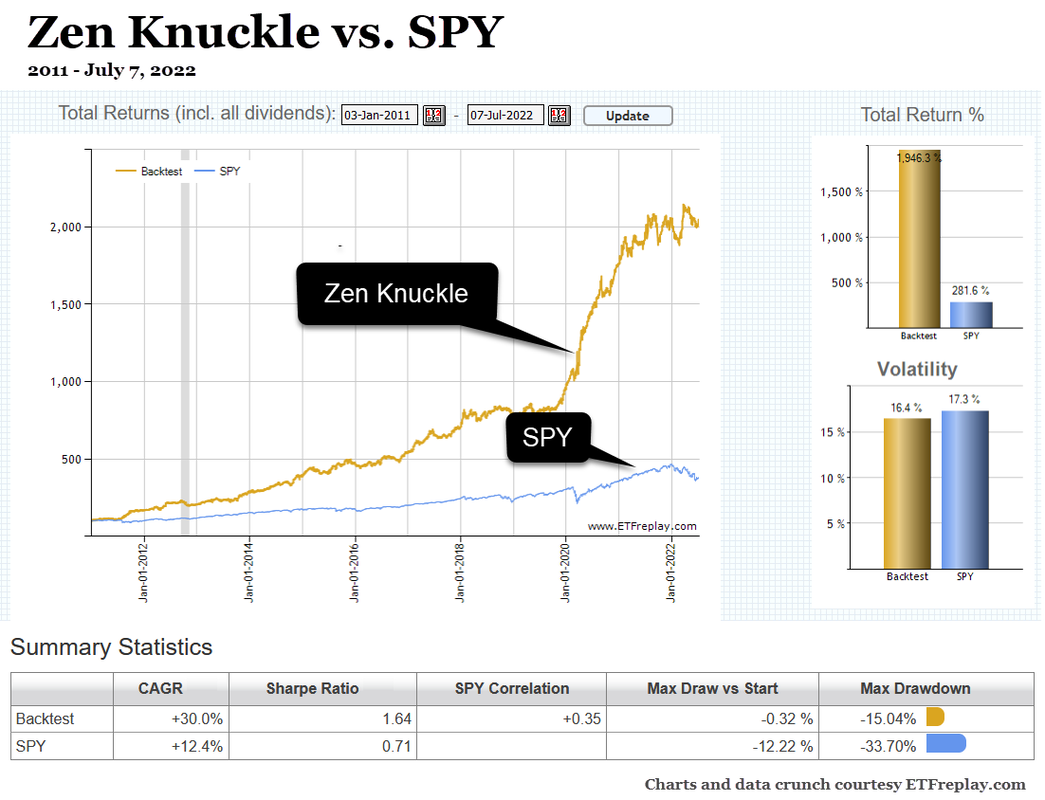

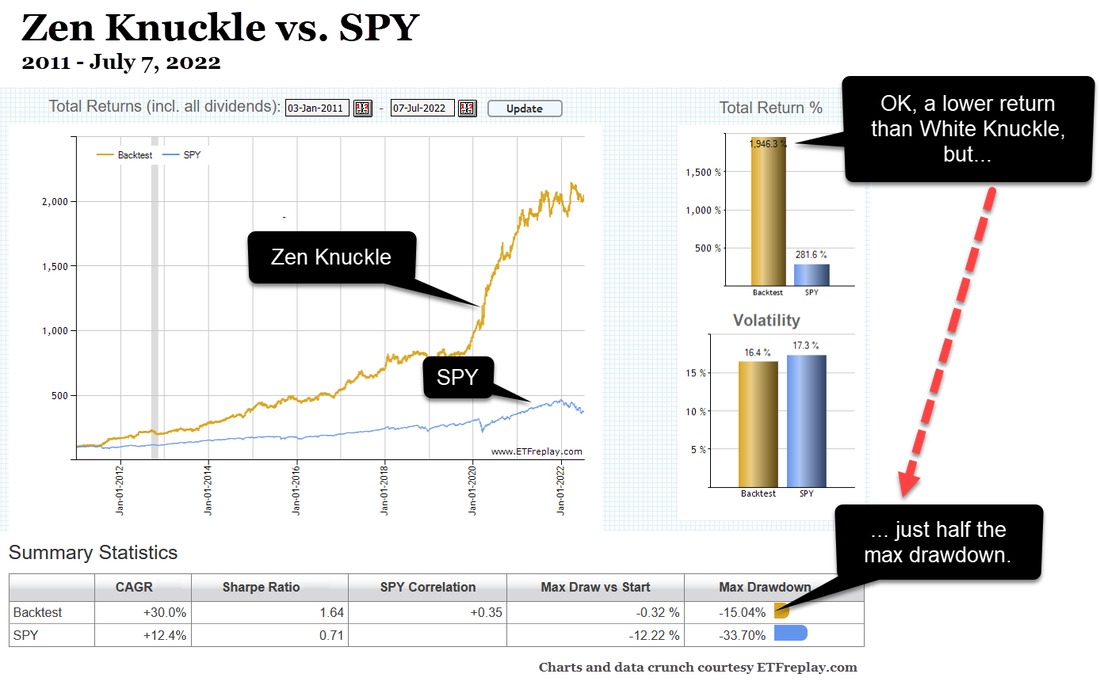

This variation swaps a volatility ETF in place of TMF. Again, this swap only applies to the 'risk-parity' portion of the strategy, which makes up 50% of the model. TMF will still make it's presence known from time to time, as it remains a component of the 'relative strength' portion of the strategy (the other 50%). Here's a quick snapshot of the new strategy backtesting to 2011 (I couldn't go back further due to the inception date of several of the components). >>> |

So, a volatility ETF with an ever-present stake in the strategy? Have I gone mad?

Possibly. After all, holding a volatility asset for longer than a few days is the antithesis of everything you've been told about volatility assets. We'll get to the numbers, but first...

Possibly. After all, holding a volatility asset for longer than a few days is the antithesis of everything you've been told about volatility assets. We'll get to the numbers, but first...

What Is The Volatility Index?

The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for near-term price changes of the S&P 500 Index. Because it is derived from the prices of options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants. The index is more commonly known by its ticker symbol and is often referred to simply as “the VIX.” -- Investopedia.

So, the VIX attempts to measure the magnitude of price movements of the S&P 500 (i.e., its volatility). The more dramatic the price swings in the index, the higher the level of volatility. Importantly for our purposes, the S&P 500 and the VIX often demonstrate inverse price action: when the S&P falls sharply, the VIX rises—and vice versa.

The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for near-term price changes of the S&P 500 Index. Because it is derived from the prices of options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants. The index is more commonly known by its ticker symbol and is often referred to simply as “the VIX.” -- Investopedia.

So, the VIX attempts to measure the magnitude of price movements of the S&P 500 (i.e., its volatility). The more dramatic the price swings in the index, the higher the level of volatility. Importantly for our purposes, the S&P 500 and the VIX often demonstrate inverse price action: when the S&P falls sharply, the VIX rises—and vice versa.

|

Yin And Yang

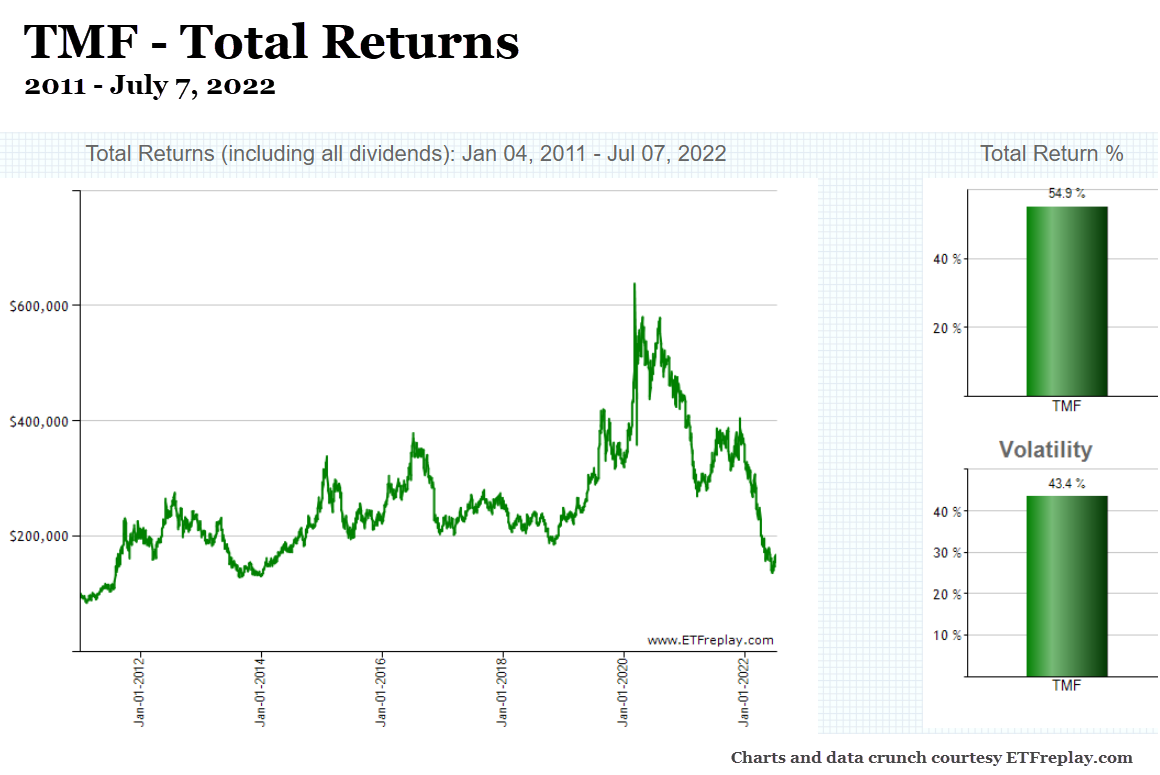

Historically, The White Knuckle has used TMF to provide that inverse price action within the risk-parity portion of the strategy. Such an inverse correlation is necessary because the other components of that risk-parity equation are two leveraged equity funds (SPXL and TQQQ) that act like SPY and QQQ on steroids. Those two levered funds, looked at separately, have massive volatility and are subject to frightening drawdowns. TMF (providing 3x daily exposure to long-term U.S. Treasury Bonds) has tended to throttle the volatility in those two equity names, and reduce drawdowns during market declines. As a side benefit, Treasuries have tended to appreciate over time, adding to overall returns beyond their primary role as protection. |

That is, until recently. Treasury bond funds have undergone a significant repricing - downward - beginning in late 2021 and extending through the first half of 2022. This, in response to the Federal Reserve raising interest rates to combat historic inflation.

While there are some signs of Treasuries stabilizing at these levels, the downtrend in these bonds over the past few months highlights the fact that an inverse relationship with equities is not a given. Their sensitivities to interest rate movements can pull Treasuries up or down irrespective of the equities market.

Yes over time, Treasuries have shown a more dependable yin and yang with equities than other popular hedges, e.g. gold, silver, commodities, etc. But it's not perfect by any stretch.

While there are some signs of Treasuries stabilizing at these levels, the downtrend in these bonds over the past few months highlights the fact that an inverse relationship with equities is not a given. Their sensitivities to interest rate movements can pull Treasuries up or down irrespective of the equities market.

Yes over time, Treasuries have shown a more dependable yin and yang with equities than other popular hedges, e.g. gold, silver, commodities, etc. But it's not perfect by any stretch.

Closer To Perfect?

The VIX. There are still issues (there are always issues - nothing is perfect). But when the broader market is crashing hard, the VIX will be spiking.

So how do we take advantage of this protection? Because the VIX is an index, one cannot buy the VIX directly. Instead, investors can take a position in the VIX through futures or options contracts, or through VIX-based exchange traded products that offer a rough approximation of the performance of the VIX.

The VIX. There are still issues (there are always issues - nothing is perfect). But when the broader market is crashing hard, the VIX will be spiking.

So how do we take advantage of this protection? Because the VIX is an index, one cannot buy the VIX directly. Instead, investors can take a position in the VIX through futures or options contracts, or through VIX-based exchange traded products that offer a rough approximation of the performance of the VIX.

|

And now, here's one of those issues I alluded to earlier: the VIX represents a 30-day forward projection of volatility. That's a relatively short time frame, and futures and options products that attempt to track the index are saddled with some unique problems, among them time decay. In short, XIV-based products are wasting assets, and fixed amounts held over time will drain brokerage accounts.

A little more forgiving are assets that attempt to capture VIX futures with 4-7 month maturities. One such product, VIXM, is an ETF that does just that: provides exposure to VIX futures with an average 5-month maturity. Make no mistake, this is still a wasting asset. See chart. >>> |

Over the past 10 years, despite significant spikes during times of market turmoil, the ETF would have cost investors an average of -17% annually. This, if investors were buying and holding a fixed amount come hell or high water.

But what if, instead, we employ the ETF as part of our monthly trading strategy? Well, that changes everything.

But what if, instead, we employ the ETF as part of our monthly trading strategy? Well, that changes everything.

|

Zen Knuckle is live and available to subscribers of The White Knuckle (or the Package Savings Plan). Subscribers will find the strategy's picks on the monthly newsletter, and can visit the Members Page to see ETF selections for past months and daily updates to the provisional picks. If you're not a subscriber and want to be, you can sign up HERE (and receive 2 months free). |

Strategy Overview

|

At its core, the Zen Knuckle (like the original White Knuckle) is a vehicle for three of the most volatile names in market: each a 3x leveraged ETF. A leveraged ETF is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. [Read more about leveraged ETFs in Investopedia.com]

The funds in question:

The last one on the list, TMF, is basically long-term bonds on steroids. Over time, long-term bond funds have tended to have an inverse relationship with U.S. equities, of which SPXL and TQQQ represent in spades. And up until now, TMF has been the third leg of the three-legged stool in the risk-parity portion of the strategy. With the Zen Knuckle, that changes. VIXM now replaces TMF, but only in the risk-parity portion of the strategy. This risk-parity portion, occupying 50% of the model, relies on a weighing mechanism whereby each fund is assigned a percentage that takes into account its relative volatility. Those percentages are recalculated each month. VIXM, the ProShares VIX Mid-Term Futures ETF, now provides the partial counterbalance to the leveraged equity ETFs. However, TMF remains an integral part of the strategy; we'll see it surface from time to time when selected by the 'relative strength' portion of the strategy (the remaining 50% of the model). This relative-strength portion includes currency ETFs and provides a valuable hedge during downtrending markets.

Where the original White Knuckle has seen drawdowns as high as -41.5%, the new Zen Knuckle has experienced a maximum drawdown of only half that, at -21.2%. In my book, that's huge - and more than compensates for the reduction in returns. Why? Because sky-high returns are meaningless if an investor is unable to hold a strategy through thick and thin.

Drawdowns of -30% and greater make it hard to hold on. Many will abandon the strategy when the going gets that tough, lock in losses, and never return. Drawdowns of half that amount are far easier to ride out, keeping the investor in the game and coming out the other side of corrections in good shape. |

Strategy Assets

|

The following securities have been selected for inclusion in The Zen Knuckle Strategy:

Risk-Parity (50% of the model):

Relative Strength (50% of the model):

Benchmark: The benchmark by which we judge the performance of The Zen Knuckle is SPY, the SPDR S&P 500 ETF. Note: EUO, UUP, VIXM, and YCS all generate Schedule K-1 tax documents. |

The Mechanics

|

50% of the Portfolio is a Risk-Parity Calculation:

Once a month, the strategy conducts a risk-parity calculation on three funds - our two leveraged equity ETFs and one volatility ETF - to determine the percentage each should occupy in half of the portfolio. It rebalances those funds according to those percentages. Each month, month after month, these three assets are ever-present in the portfolio -- only by differing amounts. 50% of the Portfolio is Relative Strength: The remaining 50% of the portfolio provides an opportunity to hedge those risk-parity bets. Using a relative strength test, if one or two of the six hedges (currencies and Treasuries) exhibit momentum strength over our equity funds, that fund (or funds) will be selected to represent 25-50% of the portfolio. And if none of the hedges test above the equity ETFs? Then the strategy will double down on one or both equity funds. To Sum It Up At any given time, The Zen Knuckle holds two leveraged equity ETFs and one volatility ETF of varying proportions that collectively make up either 100% of the portfolio, or 75-50% of the portfolio with any remainder in one or two "hedge" ETFs for further downside protection. Rinse and repeat monthly. |

Three Charts Tell The Story

|

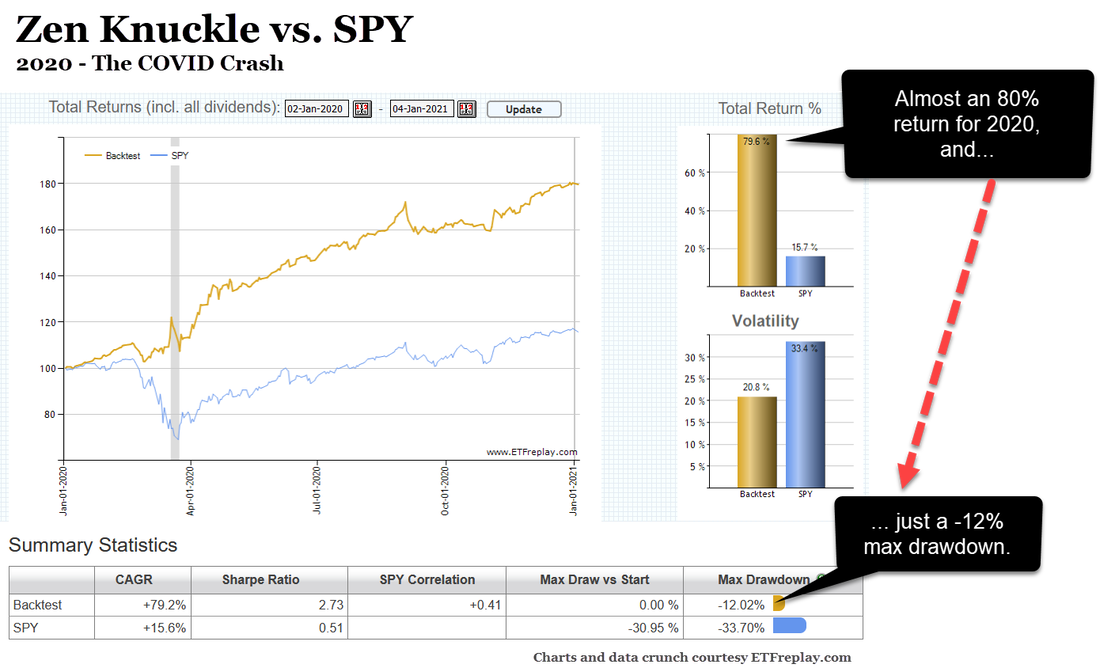

As mentioned above, during 'normal' times, VIXM is a wasting asset that sucks an average of -17% out of a portfolio if simply held. In 2020, as part of the Zen strategy, it contributed +22.9% to overall returns.

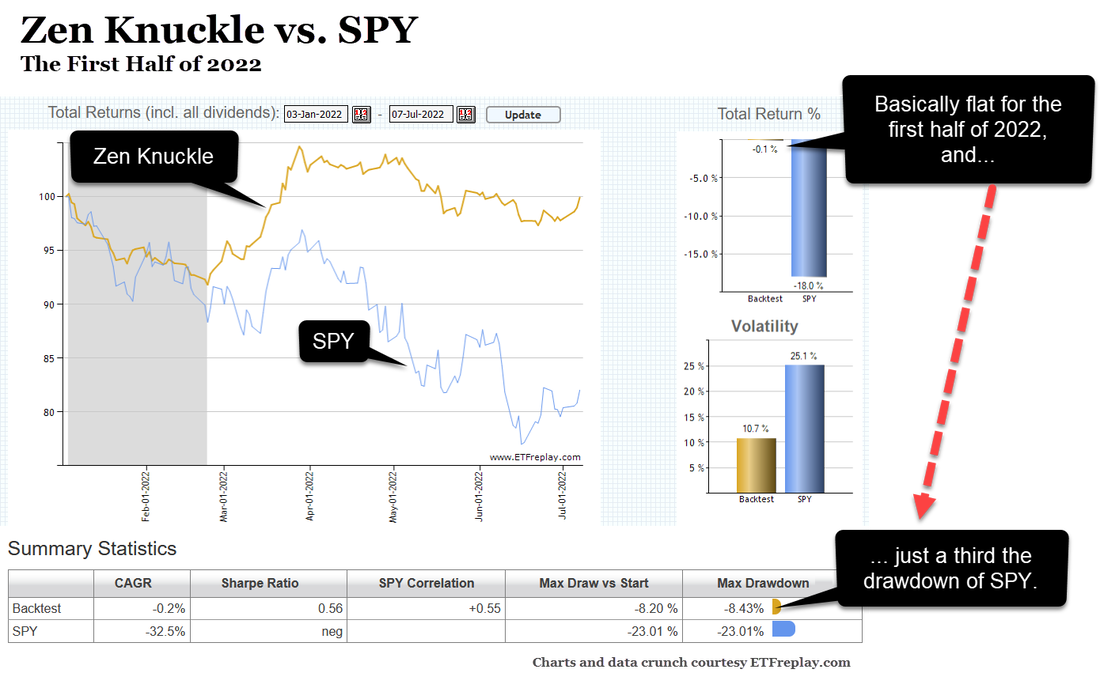

In fact, the original White Knuckle had a tough time of it, rounding the mid-year mark with a total return of -23%, worse than SPY at -18% (as of July 7, 2022). This, in large part to the negative contribution of TMF.

On the other hand, Zen Knuckle was down -0.1%, with VIXM contributing +4.7% to the portfolio for the first half of 2022. Speaking of contributions, looking back over the entire 11+ year backtest from 2011-2022 YTD, VIXM contributed +61.2% toward overall returns. That might not seem like much in a strategy that delivered almost 2,000% in returns, but remember that VIXM is a wasting asset that would have lost -89% of it's value during that same time frame if held in isolation. VIXM works within the confines of the Zen Knuckle, but certainly not as a stand-alone, buy-and-hold asset. |

Allocating Within Your Portfolio

|

Without a doubt, Zen Knuckle has reduced its risk as compared to the original White Knuckle. Volatility is lowered and max drawdown has been cut in half. But I would caution investors to remember that both of these models are vehicles for some of the most volatile names in market: leveraged ETFs.

Although the ZEN variation removes the leveraged bond fund from the risk-parity mix, TMF continues to be a component of the relative strength portion. So, it will come into play periodically. Even some of the "hedge" funds on the relative strength side are built around leverage. It's all this leverage, by the way, that delivers those sky-high returns. It's also leverage that has the potential to crush when market forces align against you. No Knuckle - Zen or otherwise - was designed to occupy more than a portion of one's total investment portfolio. How much of a portion? That depends on one's risk tolerance. I continue to recommend an allocation within one's overall portfolio of maybe 5% - 10% - 15% or so, depending on one's risk tolerance. Very aggressive investors might stretch that to 20%. As with any new trading strategy (or any single investment, for that matter), it makes sense to go light in the beginning. Stair-step your way in. One can always increase the proportion down the road after getting a feel of how the strategy handles the twists and turns of the marketplace. |

Managing Risk

|

As it stands at this moment, Zen Knuckle has lower risk factors than simply buying and hold the S&P 500. But those are past numbers, and as we all know, past performance does not guarantee future results.

So, what can investors do to manage - or even lessen - the risk? Number 1: Check your allocation. As I mentioned above, a 20% allocation of Zen Knuckle within a portfolio should be reserved for only the most aggressive investors. For conservative to moderate investors, 5-15% sounds more reasonable. Of course, it matters mightily what you're doing with the remaining 80-95%. If the bulk of your portfolio is conservative (i.e., largely bond funds, bond proxies, or conservative ETFs and mutual funds), you can afford a greater percentage of Zen Knuckle (or any other relatively high-risk strategy). On the other hand, if the bulk of your portfolio is made up of high-beta stocks or some other high-risk strategy, reduce your allocation to the Zen. For a detailed example of a portfolio made up of 75% Bond Bulls and 25% White Knuckle, see my article on Seeking Alpha: Headline Risk and Monthly Trading Models - Keeping Drawdowns In Check. True, The White Knuckle is not Zen Knuckle, but the article will provide some insight into combining strategies with quite different risk profiles. Number 2: Place stop losses. Consider placing stop losses on one or more individual ETFs within the strategy. Now, I'm not a particular fan of stop losses, and I detail why in a Q&A on the Members Page. But they are a legitimate form of risk management, and appropriate in some instances. One of those instances might be when you've gone overboard in your allocation of this strategy, and you're lying in bed with the Big Eye at night. Or if your time frame for investing is only a few years or less. Or you're uncertain as to the level of downside you can actually tolerate. For any of these reasons (and others), placing a trailing stop loss on some or all of the names on the list might be a prudent consideration. A reminder: stop losses will not protect you from overnight plunges. A stop-limit order (vs. a stop-loss order) can guarantee a price limit, but the price may not get filled and the investor is left holding the asset. If considering stops, do your research and decide your best course of action. Number 3: Keep an eye on the provisional picks. If you're not a fan of stop losses (and I can't blame you), keep in mind that every trading day I update the Members Page with the strategy's "provisional picks" (look at the bottom row of the table marked Trade History). Provisional picks represent an insight into what the strategy is thinking at the moment. They are the ETFs (and percentages) that would be picked if you decided to update your portfolio as of the close of the most recent trading day. Although the strategy only rebalances (buys/sells) one day a month, it recalculates daily based on closing prices. Potentially, provisional picks could change each day as markets moves in myriad directions. The reason we don't normally trade each provisional pick is because much of this is noise that gets filtered out by adhering to a monthly schedule. But as an alternative to placing stop losses on the stocks in the strategy, consider checking these provisional picks a couple of times a month - or more. If, for example, on the 15th of the month the provisional picks show a dramatic change in assets, don't be afraid to implement a rebalance to mirror those provisional picks. Especially if you notice that a news event has acted as a catalyst to shift the market. Sadly, it's a judgement call as to if, when, or how often you elect to implement such a trade. It's probably not something you want to do as a routine policy. But by trading provisional picks prudently, investors may be able to trim losses and/or boost returns a bit on occasion. In Sum The problem with any trading model that rebalances monthly is that there is always the chance for that model to get caught flatfooted during the month, in between rebalancing. Keeping your allocation in check is the first step in risk management. Zen Knuckle, like all the strategies, is a long-term model. In the end, a bad month here and there will be offset with good months, as the strategy self-corrects. If your allocation is reasonable and you have a long-term perspective, odds are you're good to go. And for investors looking for additional safeguards, stops can be a way to help protect against downside events in between regular rebalancing. And so are provisional picks, if used judiciously. |

Some Final Thoughts

|

The original White Knuckle has been a dynamo since the earliest date that we could backtest, that being 2011. But part of that mind-blowing performance was due in large part to its reliance on TMF (3x daily exposure to long-term U.S. Treasury Bonds) as a counterpart to the two leveraged equity funds.

As time marched on and we got to see how these three funds handled an increasing variety of marketplace traumas, I felt the strategy could be improved with another dynamic in the mix. The volatility fund VIXM fits the bill.

Swapping VIXM for TMF in the risk-parity portion of the strategy, while still having TMF available to contribute from time to time, reduces overall risk in the model. Yes, it also reduces returns. But investing is a balancing act; achieving an acceptable level of return while maintaining a comfort level with the risk involved. I believe the Zen Knuckle improves on that balance, as evidenced by its Sharpe ratio. The Sharpe ratio seeks to characterize how well the return of an asset compensates the investor for the risk taken. When comparing investments or portfolios, the one with a higher Sharpe ratio is considered superior relative to its peers. Looking at performance from 2011 to Present [Nov 1, 2023]...

So, why not make this Zen variation the new White Knuckle? It may yet happen; let's give it a few months. But for the time being, I've set up Zen Knuckle as a separate strategy. The White Knuckle carries on, and investors can choose which they are more comfortable with. Remember, the website's Disclaimer and Terms of Use apply to this strategy as well as all others. Best of luck, David Alan Carter Zen Knuckle is live and available to subscribers of The White Knuckle (or the Package Savings Plan). If you're not a subscriber and want to be, you can sign up HERE (and receive 2 months free). |