Why? Because The Coffeehouse Portfolio is a static, buy-and-hold portfolio that rebalances annually to keep its assets in line with the model's percentage calculations. On the other hand, The 12% Solution is a dynamic momentum model that seeks out relative strength leaders among a small pool of ETF candidates. As such, it has the potential to trade monthly.

What are the practical implications of these two different types of models? For starters, The Coffeehouse Portfolio is often labeled -- along with a dozen or so popular and competing buy-and-hold portfolios -- a "Lazy Portfolio." Meaning, this is the type of investment plan that requires very little maintenance. These are passive investing strategies; you set 'em and forget 'em -- at least until it's time for the annual rebalancing.

The 12% Solution, conversely, is a more hands-on investment model, usually requiring a monthly trade or two. Or at the very least, time spent each month (15-20 minutes) deciding whether a trade or two is required.

So that's the first thing: one model is more of a time commitment than the other. The second implication, and this is potentially big, has to do with taxes. Buy-and-hold portfolios, by definition, don't have the same degree of tax implications that monthly trading models do. That's not to say they don't generate taxable income -- they do. Just not on the same level as the monthly models. More on this toward the end of the piece.

So, you might ask, why even compare apples and oranges? Because a lot of folks (i.e. new investors) may not even know that apples (or oranges) exist. And knowing might start them down a road of further research and -- ultimately -- better investment decisions.

So lets get to it.

What are the practical implications of these two different types of models? For starters, The Coffeehouse Portfolio is often labeled -- along with a dozen or so popular and competing buy-and-hold portfolios -- a "Lazy Portfolio." Meaning, this is the type of investment plan that requires very little maintenance. These are passive investing strategies; you set 'em and forget 'em -- at least until it's time for the annual rebalancing.

The 12% Solution, conversely, is a more hands-on investment model, usually requiring a monthly trade or two. Or at the very least, time spent each month (15-20 minutes) deciding whether a trade or two is required.

So that's the first thing: one model is more of a time commitment than the other. The second implication, and this is potentially big, has to do with taxes. Buy-and-hold portfolios, by definition, don't have the same degree of tax implications that monthly trading models do. That's not to say they don't generate taxable income -- they do. Just not on the same level as the monthly models. More on this toward the end of the piece.

So, you might ask, why even compare apples and oranges? Because a lot of folks (i.e. new investors) may not even know that apples (or oranges) exist. And knowing might start them down a road of further research and -- ultimately -- better investment decisions.

So lets get to it.

The Coffeehouse Portfolio

by

|

Bill Schultheis is a principal and fee-only financial adviser with Soundmark Wealth Management in Kirkland, Washington. A former Smith Barney broker, syndicated investment columnist, and frequent guest contributor on NPR’s Morning Edition, Schultheis wrote the book, “The Coffeehouse Investor” in 1998.

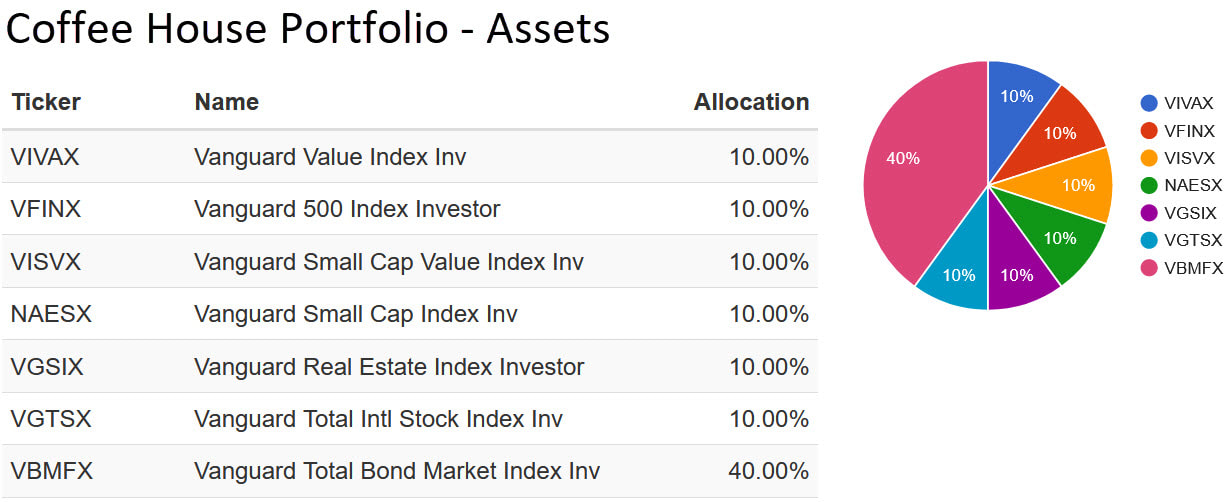

The Coffeehouse Portfolio, based on the book, starts with a 60/40 allocation to stocks and bonds. The 60% in equities is then subdivided into 6 equal portions: a large-cap value fund; a large-cap fund; a small-cap value fund; a small-cap fund; a REIT fund; and an international fund. The bond portion goes to a single fund mirroring an intermediate bond index. Here’s how that looks in terms of mutual funds and allocations, courtesy of Portfolio Visualizer >>> |

The 12% Solutionby

|

The 12% Solution is a monthly ETF rotation strategy based on the book by the same name, and developed by yours truly. With a management background and more than 20 years of investing experience ranging from options and futures to high-frequency day trading, I've spent the last four years focused on the development of automated trading systems.

In general, The 12% Solution is a simple, do-it-yourself timing model that taps the time-tested "momentum effect" in trading and includes an innovative cash trigger that offers protection during bear markets. The book identifies 6 index fund ETFs as well as a couple of bond funds as candidates for monthly trading. Without getting into the specifics, the methodology for selecting which ETFs to buy and which to sell --as well as the timing of those trades -- is fairly straightforward, and outlined in the book. Designed primarily to reduce risk and volatility in a portfolio, the strategy has shown the added benefit of beating the S&P 500 over time, as well as the great majority of money managers and mutual funds. Let's see how it fares against the Coffeehouse Portfolio. |

First, A Word About Drawdowns

|

Returns are important. Darn important. But so too are the risks associated with performance during market meltdowns.

Chief among those risks: the drawdown. A drawdown is a measurement of decline from peak to trough, before a new peak is attained. It can refer to an asset, fund or portfolio, and is usually expressed as a percentage from top to bottom. A maximum drawdown is the largest of such drawdowns measured during an interval of time. That doesn’t mean things can’t get worse for the asset, fund or portfolio. It just means they’ve been that bad in the past. Drawdowns are the biggest threats in investing for two reasons. 1) They destroy capital. You can argue that those are only paper losses if the assets are not sold. But recovery takes time, and time is money. 2) They destroy investor confidence. Countless investors who bailed at some point during the 2008-2009 market slide have yet to get back in, not only cementing those losses, but missing out on a triple gainer since. Everyone’s tolerance for risk is different. While some can handle a 20% drawdown, others will jump ship at 10%. Knowing your risk profile is critical. Sadly, sometimes you can’t know that profile until your portfolio is put to the test. Let's see how each of our two respective portfolios performed during each of two distinct crises from the recent past. We'll start with the mess we're currently in -- the COVID-19 crisis of 2020. And since this crisis is ongoing, as of the date of this piece, we''ll limit ourselves to roughly the first quarter of 2020, capturing the historic collapse of the market that began in March and culminating at the low point of the year (we hope) on March 23. |

COVID-19 Crisis

|

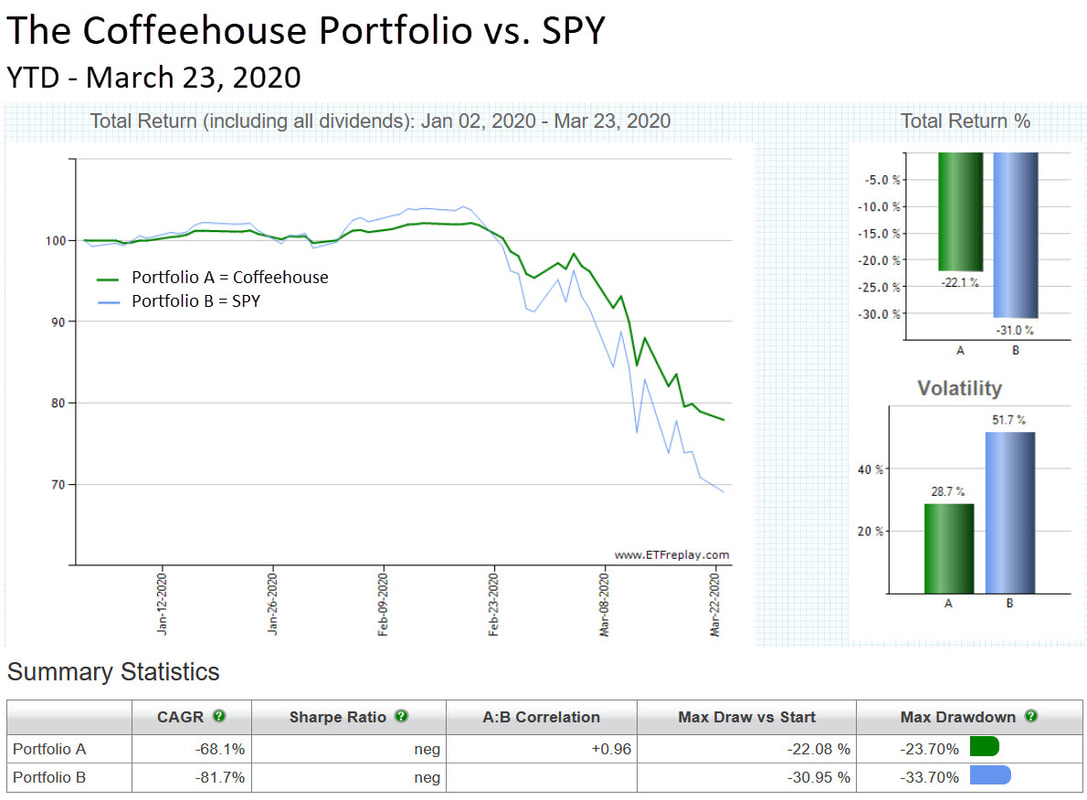

The first thing I’m drawn to: Total Returns. There’s SPY, down -31.0%. And not far behind, the Coffeehouse at -22.1%.

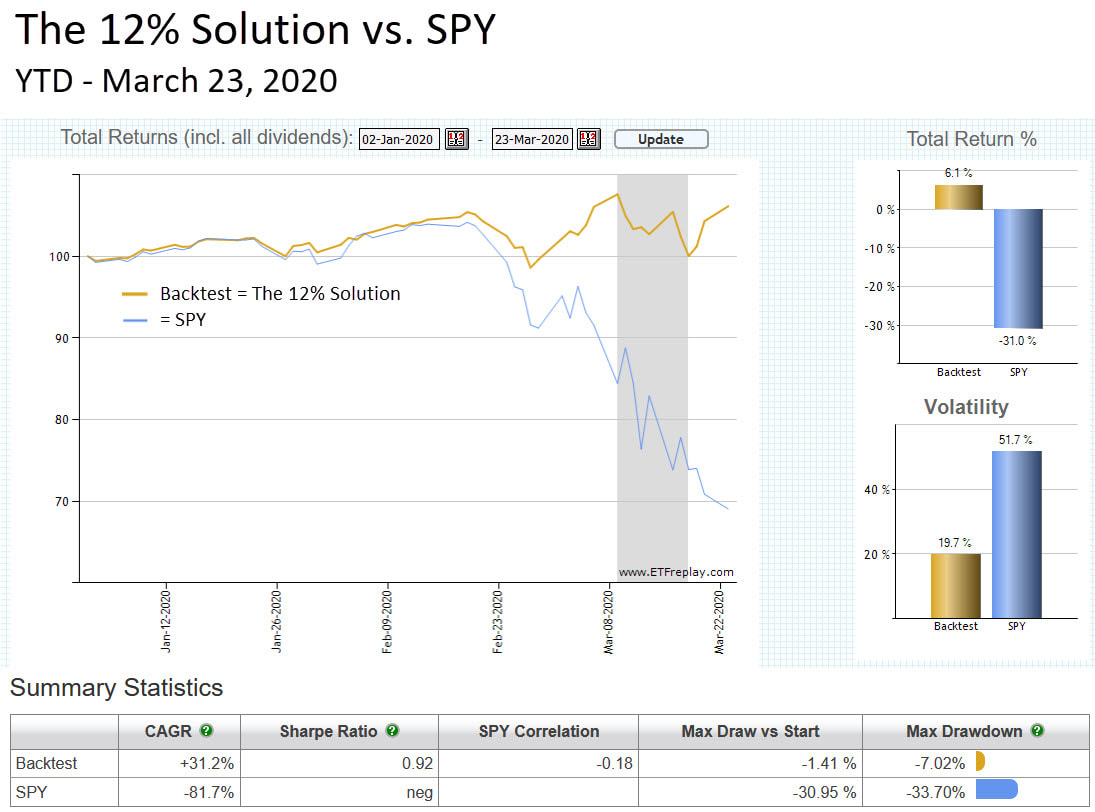

Thankfully, volatility for The Coffeehouse was half that of SPY. But max drawdown was a stomach-turning -23.7%. While that wasn’t as bad as SPY’s drawdown, I’m pretty sure it was enough to give some investors the Big Eye at night. How did The 12% Solution do? The chart below tells the tale. [The tan line is The 12% Solution. The blue line is SPY, our benchmark.]

|

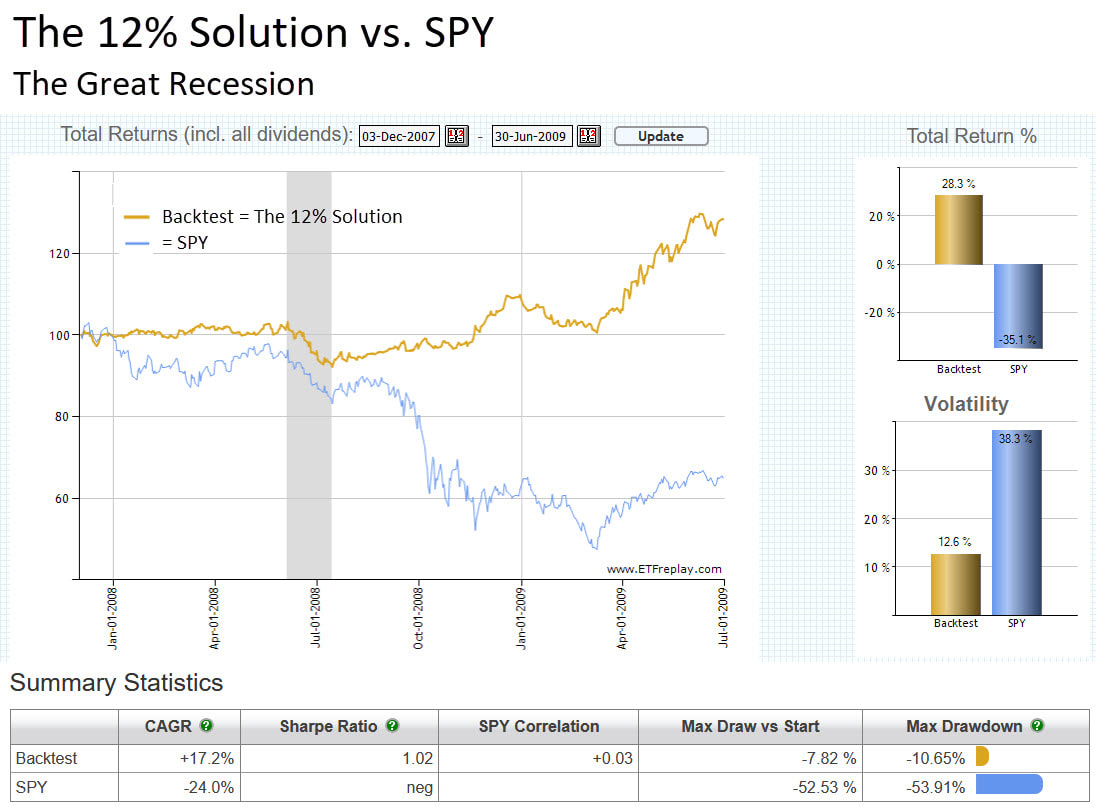

The Great Recession

|

The latter is important because countless investors bailed at or near the bottom of the market in 2009. The pain and the uncertainty just became too great. And many of these folks never got back into the market. Or got back in just in time to experience the COVID-19 market meltdown.

This is the great tragedy of the severe drawdown. It crushes not only portfolios, but spirit as well. And even for the investor who held on and suffered only a paper loss, the climb back up and out of a -54% chasm is longer, tougher slog than coming out of a -37% sinkhole. But lets be honest: a -37% hole in your portfolio is not exactly something to crow about. Sure, it beats the alternative chasm. But no doubt a significant number of investors abandoned even this “safer” model during the depths of the gloom and doom. Picture the soon-to-be retiree clinging by his fingernails to a million dollar portfolio, watching as that portfolio loses $370,000 – perhaps 30 years of savings -- just before his gold watch. Would the typical investor have the fortitude to stick with such a strategy? Let's see how The 12% Solution performed during the Great Recession.

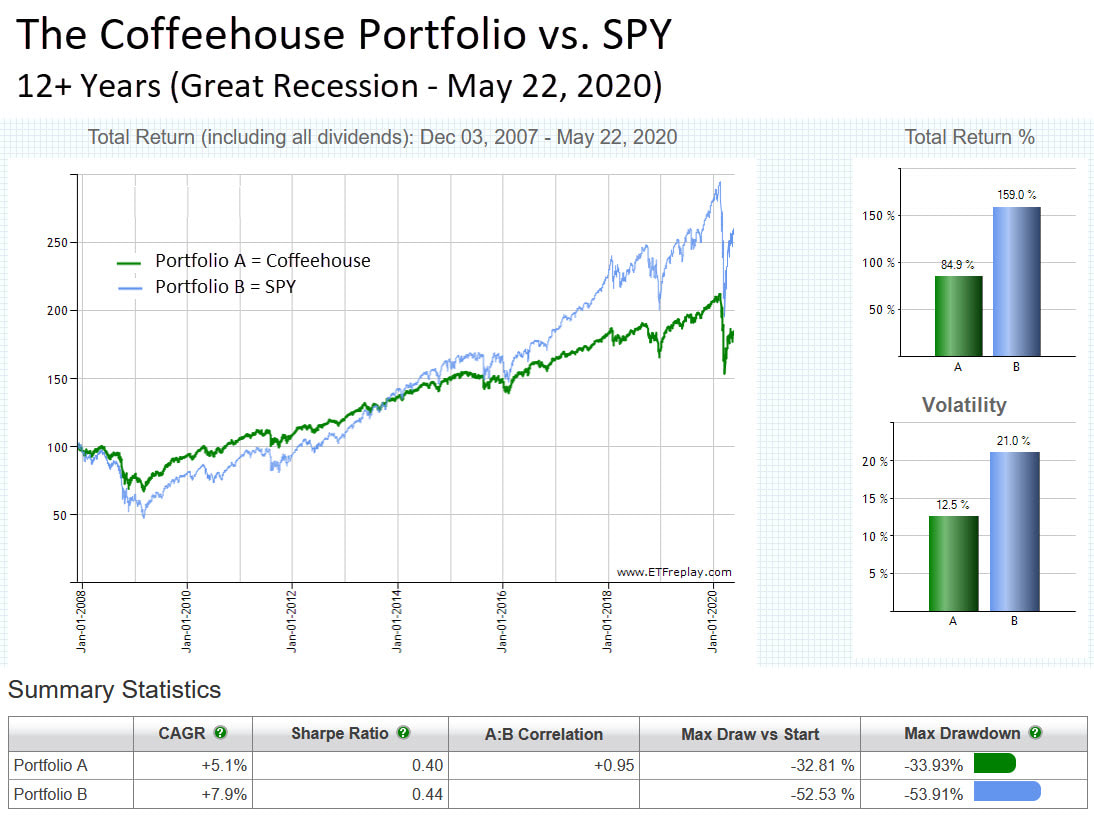

What has become clear, over the course of two dramatic bear markets, is this: The Coffeehouse is not a panacea during turbulent markets. With middling to poor performance during downturns, and risk factors that can come close to mirroring the S&P 500, its ability to protect portfolios is not a sure bet.

Admittedly, nothing is a sure bet in the stock market. And I’ll take The Coffeehouse’s recent drawdown over SPY’s any day. But all things being equal, uncertainty regarding protection should at least come with a return over the long run that compensates for that uncertainty. Does it? Let’s find out. |

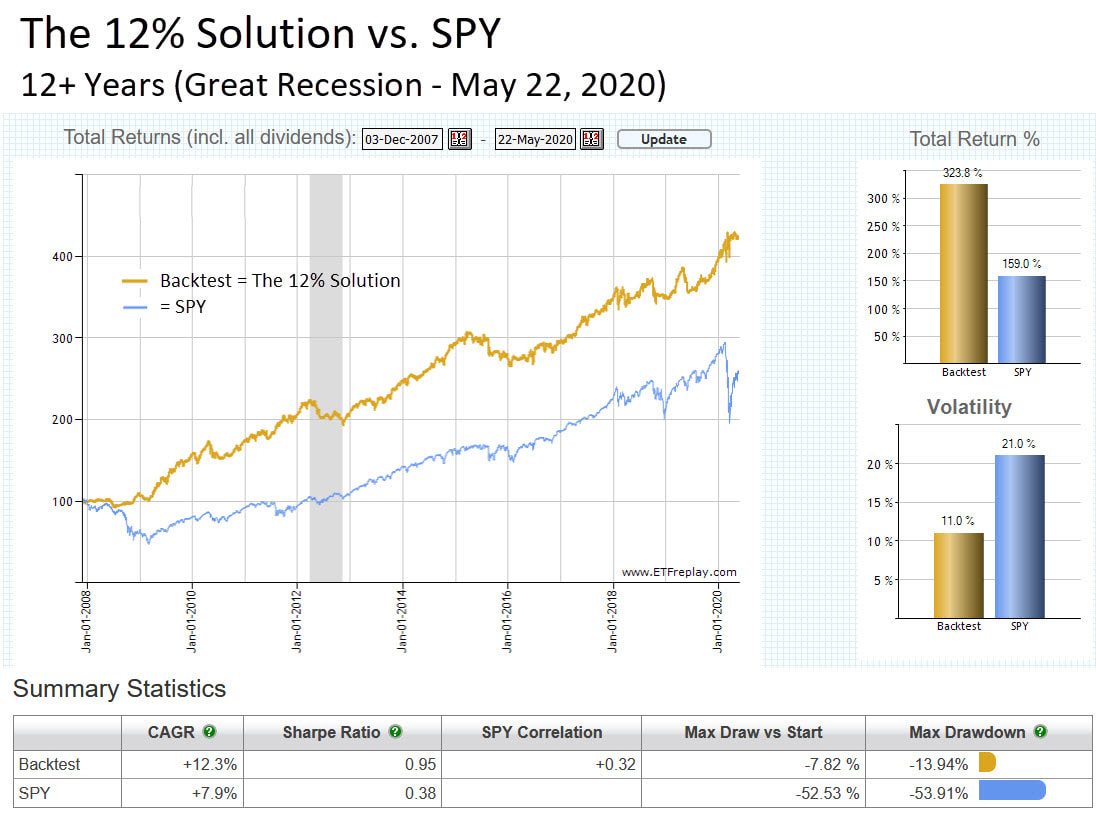

A 12-Year Backtest

|

But watching nearly 34% of one’s portfolio evaporate during a market meltdown would be extremely tough for many retail investors to handle. The principle purpose of any static, buy-and-hold portfolio is to level out the ride and reduce risk enough to keep the investor invested.

Certainly the consensus view is that no diversified buy-and-hold model can be expected to exceed – or even match -- the benchmark over the long run. That’s the commonly accepted price one pays because such a diversified model is expected to reduce volatility and max drawdown to the point where investors can sleep well at night and let the chips ride. That’s the supposed value of the buy-and-hold model; to keep you in the game. You don’t come out ahead in the stock market by being out of the stock market (e.g., burned from losses and afraid to venture back in). In the end, I can’t speak for other investors. Everyone has their own tolerance for risk and their own idea of compensation for that risk. Note that CAGR is 5.1%. CAGR stands for compound annual growth rate, and assumes a constant rate of return over the time frame indicated. Does a 5.1% annual return offer adequate compensation for the next potential -34% drawdown? Investor’s call. Let's see how The 12% Solution performed during this same time period.

Panacea? Again, no. As I alluded to earlier, monthly trading models generate taxable income in the form of short-term capital gains. While income from dividends and fund distributions will be taxed equally whether the portfolio is a buy-and-hold or a monthly trading model, gains from the sale of assets are treated differently depending on the holding period for those assets.

Buy-and-hold portfolios that rebalance once a year can generally be assured of being hit with more favorable long-term capital gains on the sale of assets. Monthly trading models are destined to generate the more onerous short-term capital gains. How much difference it makes will depend on each investors' tax situation. One way to turn this into a non-issue is to trade in a tax-advantaged retirement account. A tax-deferred account shields interest, dividends, and capital gains from taxes until the investor takes constructive receipt of the profits (via withdrawals, which are then taxed as regular income). A tax-free account, such as a ROTH IRA, goes one step further and allows interest, dividends, and capital gains to accumulate with no tax liability whatsoever. If an investor does trade in a traditional, taxable brokerage account, that investor needs to determine if the projected improvement in performance is enough to offset the associated tax burden. That's something only each investor can determine. |

Conclusion:

|

The Coffeehouse, like other popular buy-and-hold portfolios, reduces risk by carefully selecting and owning uncorrelated or minimally-correlated assets in particular percentages. On the surface, this makes intuitive sense. And in its day, factoring in this connection between risk and return was a profound improvement in the way investors looked at portfolio management.

But for the buy-and-hold investor, that’s the only tool in the tool bag for reducing risk. Each model will jimmy around with particular assets and percentages, but the overarching fact is that, given the static nature of these models, there is no other option beyond owning combinations of assets that are not well correlated. The results are portfolios that neither excel to the upside, nor materially protect the downside. This appears to be the case with The Coffeehouse. But owning combinations of assets represents only one method of reducing risk in a portfolio. Risk avoidance is another. Meaning, getting out of the way of an asset that’s heading south before it can drag down your entire portfolio. This is something that static portfolios simply can’t offer, unless they’re holding nothing but cash. Short of holding nothing but cash, risk avoidance can only be accomplished by employing an active management model. A model that attempts to own the trend leaders and avoid the trend laggards. The 12% Solution is such a model. Best of luck, David Alan Carter |

Explore Further

|

Both strategies are outlined in books by their respective authors. Clicking a cover below will take you to that book's Amazon page for more information.

TrendlineProfits.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. Read our affiliate link policy for more details.

|