The 12% Solution: Combinations For Higher Return, Less RiskDavid Alan Carter

June 19, 2023 OK, what's not to like about The 12% Solution? It's a powerful strategy that's simple, understandable, and gets the job done year in and year out. And I should know - I wrote the book on it, and it remains the cornerstone of my own investment portfolio.

|

But what if I told you that combining The 12% Solution with one or two of my other models could provide more diversification to your portfolio and give overall performance a little more oomph over time?

That's nice, you say. But how much more diversification? And how much more oomph?

Let's find out.

That's nice, you say. But how much more diversification? And how much more oomph?

Let's find out.

First, Our Base Line |

Because we're looking to improve the performance of our portfolio, it would make no sense to combine The 12% Solution with another strategy or two if those other models can't outperform The Solution in one form or another. So, for starters, let's review what we've already got in The 12% Solution.

Dating back to The Great Recession and fighting our way through last year's ugly bear market, The 12% Solution delivered the following over a 15 year history (2008-2022):

By the way, that handily beats the S%P 500, which clocked in with a 254.9% Total Return and a CAGR of 8.8% for the same period.

|

Now Let's Add Some Muscle |

American Muscle taps key U.S. sectors as well as the three largest companies in the S&P 500. Risk is kept in check with a TLT hedge and a bear market trigger that can move the bulk of the strategy into defensive ETFs, Treasuries, or cash during downtrending markets.

American Muscle delivered the following over a 15 year history (2008-2022):

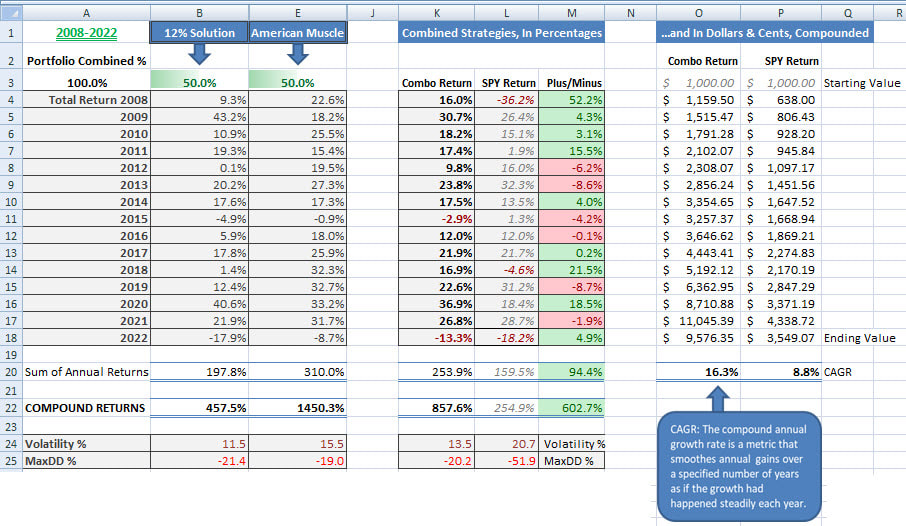

Let's get specific and consider a 50/50 combination of The 12% Solution and American Muscle. The CAGR (average annual return) of such a combined portfolio would have been 16.3%. That's better than a 4% improvement in annual returns (on average) as compared to 12.1% for a portfolio trading only The 12% Solution.

Here's how that looks on the Returns Calculator...

And diversification? With this combo, in any given bull-market month, there might be a broad-market ETF and either TLT or JNK (from The 12% Solution), as well as one or two U.S. sector funds, or even one or two of the top 3 powerhouse stocks from the S&P 500 index (from American Muscle). During bear markets, The 12% Solution might be largely in cash, while American Muscle will have dividend aristocrats, industrials, and utility ETFs competing with Treasury funds for the best safety play. |

And The Other Strategies? |

Each strategy, in combination with The 12% Solution, would bring something different to the table.

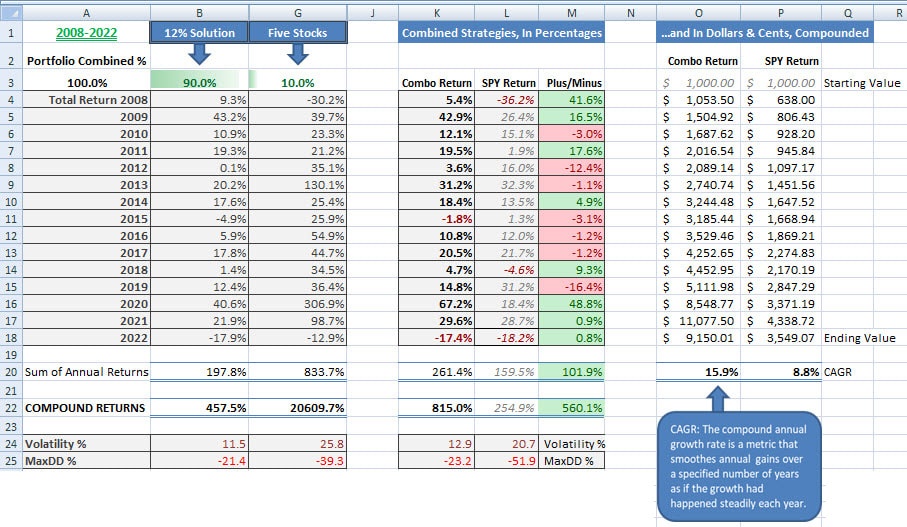

Bond Bulls is my "sleep well at night" model, with the lowest risk factors of any of the strategies. A 50/50 combination with The 12% Solution would have pulled down Total Return to 11.2% over the 15 years, but it also would have reduced maximum drawdown to a more comfortable -14.6% vs. the -21.4% for a portfolio trading only The 12% Solution. Global Trader provides exposure to international equities. A 50/50 combo would have delivered a 15.3% CAGR over the past 15 years with a reduced max drawdown. Diversification would have improved dramatically, with international index and sector funds providing a counterbalance to the domestic ETFs of The 12% Solution. White Knuckle can be a bit of a scary ride. Let's save that for another time. But its close cousin, Zen Knuckle, is less so. With a 26% CAGR over the past 12 years, that will definitely add some firepower to a 12% Solution combo - so long as you limit your Zen exposure to 5, 10, or 15% or so of your overall portfolio. And finally, Five Stocks. Let's tread gently with this one and assume a 90/10 combination of The 12% Solution and Five Stocks. Over our 15-year backtest, this combination would have delivered a 15.9% CAGR, besting a portfolio trading only The 12% Solution by 3.8% annually (on average). And it would have done so with only a slight boost in max drawdown. Here's how that looks on the Returns Calculator... |

What About Multiple Strategies? |

If adding an additional strategy to one's portfolio improves performance over the long run, what about adding two? Or three?

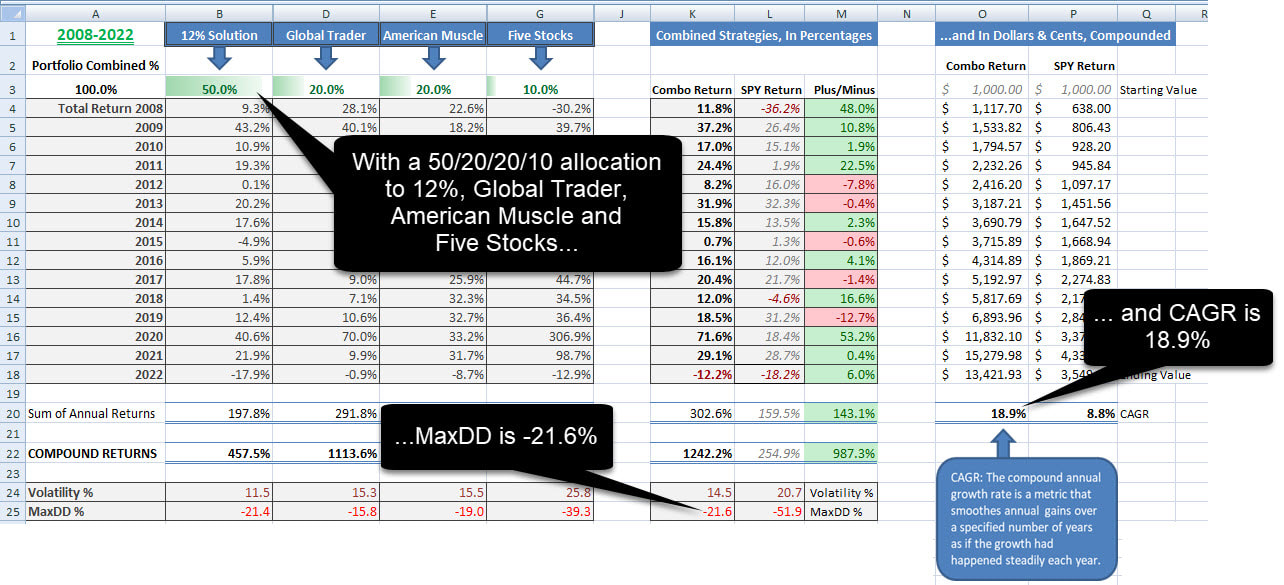

Certainly, you'd benefit from additional diversification; each strategy pulls from different asset classes (although there is some overlap at times). Multiple strategies at work in a portfolio can also improve risk metrics and total returns. As an example, employing The 12% Solution, Global Trader, American Muscle and Five Stocks in a 50/20/20/10 allocation would have delivered a CAGR of 18.9% over the 15-year backtest. That's a 6.8% annual boost (on average) over a portfolio trading only The 12% Solution. And it would have done so with roughly the same maximum drawdown suffered by The 12% Solution. Here's how that looks on the Returns Calculator... [Note: Subscribers to The 12% Solution or any of the paid models can experiment with their own combinations using the Returns Calculator.] |

Is An Extra 3-4% Worth It? |

We've seen a couple of examples of strategy combinations that could potentially add 3-4% annually to your portfolio. And in one case, over 6%. But that boost in performance comes at a cost. Specifically, the cost of a subscription.

So, do the numbers make sense? Let's explore some hypotheticals... My subscription plans range in price from $14.95/month (for a single strategy like Bond Bulls, Global Trader or American Muscle), to $24.95/month for the MAX Pak (all 5 strategies, including the new Five Stocks).

Let's be conservative. Assume you could boost your returns by just 3% annually (on average), but to do so costs you the max that I charge - $24.95/month (or $299.40/year). Is it worth it? If your portfolio is $10.000, a 3% annual boost beyond 12% delivers an additional $300 the first year. That just so happens to be the cost of my MAX Pak. You break even. If your portfolio is $25,000, a 3% annual boost beyond 12% delivers an additional $750 for the first year. Discounting the subscription, you're ahead by $450 the first year. If your portfolio is $50,000, a 3% annual boost beyond 12% delivers an additional $1,500 for the first year. Discounting the subscription, you're ahead by $1,200 the first year. We could go on, but you get the point. And again, a hypothetical 3% gain in any single year is simply an expression of the average drawn over 15 years. Now here's something interesting; a portfolio generating percentage returns over time begins to benefit from the magic of compounding. So that $10,000 portfolio that you broke even on in the first year becomes a $40,000 portfolio in ten years (assuming an average annual return of 15%, which is 3% over The 12% Solution). And that $50,000 portfolio? At the end of ten years that's turned into a $200,000 portfolio. That's $45,000 more than The 12% Solution would have hypothetically delivered all by its lonesome. True, that extra $45,000 would have cost you. Specifically, it would have cost you a $300/year subscription x 10 years = $3,000. So, the net is more like $42,000, not counting trading fees or taxes (if trading in a taxable account). Still, a substantial gain. And of course, that just continues to expand as the years roll on. Obviously, starting with a larger portfolio, or contributing money on a regular basis, or gleaning an additional percentage point or two from personalizing your mix of strategies, could see exponentially more in returns over time. For example, getting a 5% boost in returns (beyond The 12% Solution) takes that $50,000 and turns it into $240,000 in 10 years. Keep that up for 20 years, and you're looking at more than a million. No guarantees, of course (see caveats below). But compounding is heady stuff. You can see for yourself how compounding can transform a portfolio by checking out the government's Compound Interest Calculator. In the end, only you can decide if a subscription to an additional strategy (or strategies) is worth it. While my MAX Pak package plan runs $24.95/month, there are two other package plans to consider (at $21.95/month and $19.95/month). And three strategies are each available solo at $14.95/month - including American Muscle, which was detailed above.

All subscriptions come with a 2-month free trial for new subscribers. See all the pricing details on the Pricing Page. |

Three Caveats

|

First up, the strategies on this website have delivered strong past performances both in my own portfolios and in backtesting. But according to the first rule of investing, past performance is no guarantee of future results.

Secondly, the examples above imagine combos with various models and allocations (50/50, 90/10, etc.). These are arbitrary numbers and such portfolios may not be suitable for any particular individual investor. And finally, max drawdowns are historical points of reference. They are the largest drawdowns the strategies have experienced over the time frames cited. They are not floors, they are not safety nets. In fact, always assume the largest drawdown for each of the strategies (or for that matter, every stock, ETF, and mutual fund) is lurking out there in the future. Best always, David P.S. Whether you end up employing just The 12% Solution or a combination of strategies, by all means check out the Portfolio Allocation Calculator to make your life easier on rebalancing day. |